29 Jul MARKET UPDATE: A GREAT ROTATION?

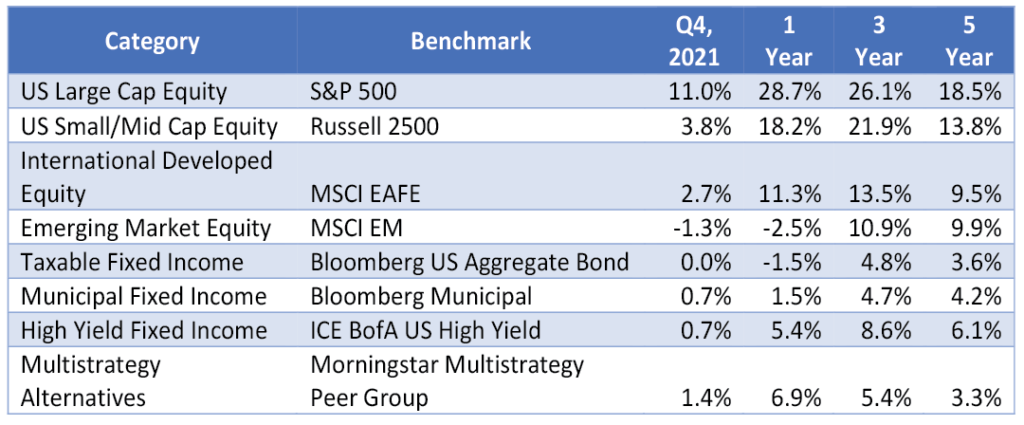

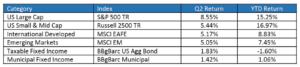

Markets broadly continued to trend higher throughout the second quarter and into the start of the third quarter, despite some pockets of weakness. Throughout the second quarter of 2024, US large-cap stocks advanced while their small and midcap counterparts trailed. Emerging market equities were the best performing of the major asset classes, jumping 5.4% after lagging other major equity markets to start the year. Fixed income remains slightly positive on the year as higher yields have lessened the impact of rates moving higher.

Valuations

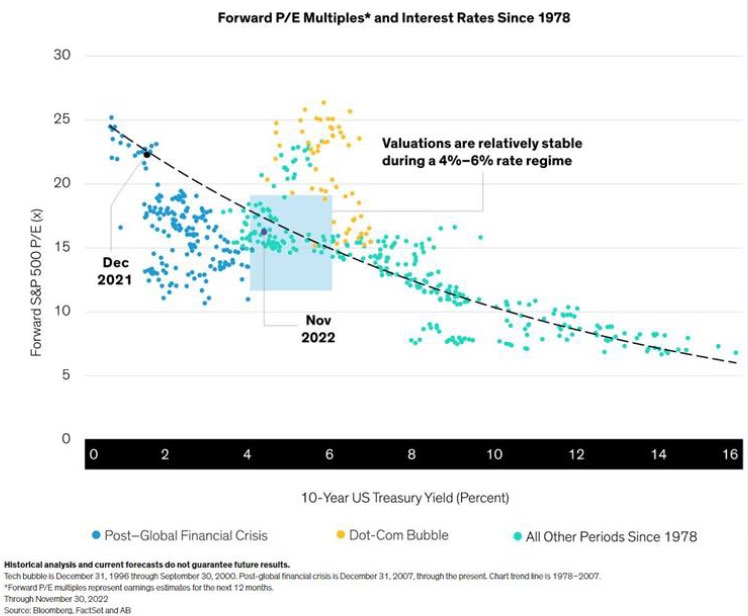

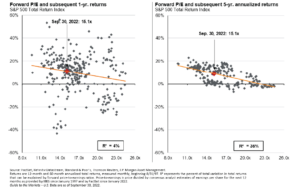

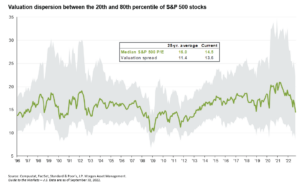

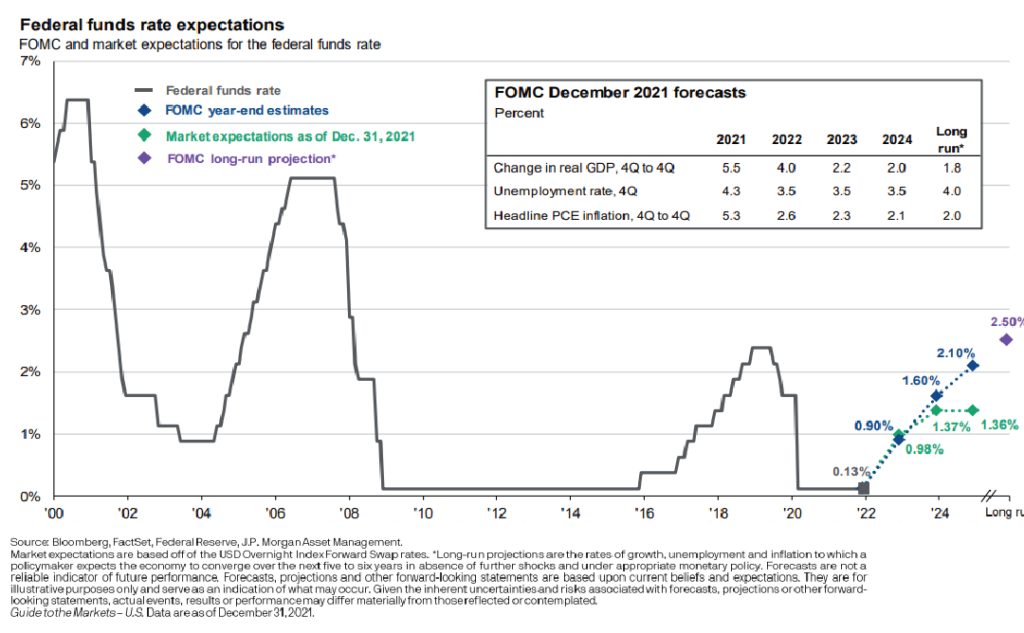

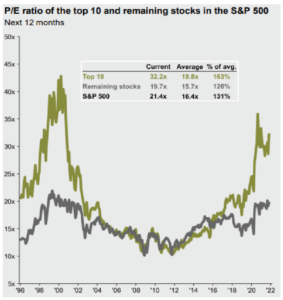

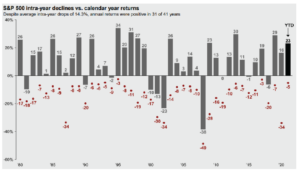

The start to the third quarter was strong as well, with both equity and fixed income markets advancing. We have seen a slight rotation out of large-cap growth and into large-cap value and small-cap equities to start the quarter. This is part of a normal market cycle and frankly a welcome sign for the health of the overall equity market. We entered the third quarter with S&P 500® valuations well ahead of historical averages. This was especially true of US large-cap growth stocks who sported a price to earnings ratio of 28.4x. This was 150% of the historical 20-year average of 19x earnings. While there is no single most important metric for evaluating the overall valuation of the equity market, price to earnings gives a good representation of the premium you are paying for earnings today versus what a “normal” market environment looks like. These P/E Ratios are historically a good predictor of future returns and with valuations where they were at the start of Q3, future return expectations were becoming limited.

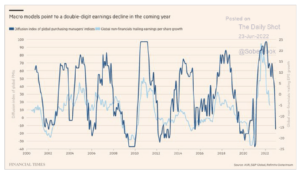

While valuations grew richer for US large-cap growth stocks, we saw market concentration climb as well, reaching levels last seen in the 1960’s. The top 10 names in the S&P 500® made up 37% of the index at the end of the second quarter. It is no secret that names like Nvidia, Microsoft, and Meta have been leading markets to new all-time highs throughout the last year. The growth of the “Mag-7” (Microsoft, Apple, Nvidia, Amazon, Alphabet, Meta, and Tesla) has been immense, with valuations and index weightings climbing as these stocks continued to hold the lion’s share of earnings. Investor attraction to these names left the remaining 493 stocks in the S&P 500® producing muted returns, with the average stock up just 5% year to date. As of the end of the second quarter, the percentage of S&P 500 stocks outperforming the index was at a record low.

The last time valuation dispersions were similarly extreme, and leadership was this narrow, was during the 90’s Technology Bubble. Those who ignored valuation and bought into the bubble missed investment themes that lasted more than a decade. The chart below compares the total returns of the S&P 500® Value Index and the S&P 500® Growth Index from the Tech Bubble’s peak in March 2000. From that date, value cumulatively outperformed growth for the next 20 years and 2 months. It wasn’t until the recent post-pandemic period that growth cumulatively regained the performance lead from that start point.

A Market Rotation

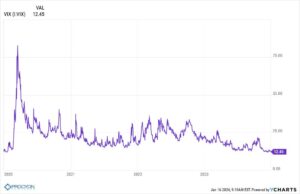

The start of Q3 has been an evolving story as there has been a sharp market rotation over the last few weeks. The market rotation really started on July 10th, when mega cap names fell, and the broader market moved higher. Since that time, growth stocks are down -5.5% while value is up +2.41%. Additionally, small-cap stocks have outperformed large-cap stocks by nearly 9 percentage points (+6.62% vs. -2.2%) in just eight trading days. Mag 7 stocks have borne the brunt of this rotation, with Nvidia down -12.6%, Meta down -10.8%, and Amazon down -8.3%. Apple has held up the best of the bunch (-3.72%) but still trails the benchmark over that period.

The cause of this rotation is not fully known or understood by experts at this time. While everyone wants to point to one specific thing, there are several different reasons why this could happen and could continue. Was it softening inflation numbers and a change to the Fed’s anticipated monetary policy stance? Was it the coming election cycle and associated candidate rhetoric about potential policy for the next 4 years? Was it simply rebalancing from large market participants (i.e. hedge funds) as growth stocks notched a stellar 1st half? Or did the technology trade get crowded, and investors went searching for other opportunities? In any event it was certainly a momentum crash as that is the dominant factor within the large-cap growth space.

While eight trading days is not long enough to identify a trend, or a new market regime, the speed of the market reaction is a good reminder to investors as to why we maintain diversified portfolios. One single market is not always going to be king. Some rotations are fast, some are slow; some are long-lived, while others are just a flash in the pan. Our goal is to maintain exposure to all these markets to achieve long term portfolio growth no matter who or what is leading the market on any given day.

Is Value Dead

Given that backdrop, it is worthwhile to raise a question that has been posed by many: is value dead? It is a fair question to ask in light of growth stocks outperforming value over a 10-year rolling time period.

The basic assumption to traditional value investing is that capitalism is an ongoing economic structure, and one should be optimistic about the future. Value investing believes that investors should search for undervalued growth because many companies within the economy will grow. It also is a belief that markets are not always efficient, and opportunities are available to those who remain patient.

Many investors believe that growth investing is only about an exciting future, growth investing is now largely based on the notion that only a select universe of companies can actually grow. Be it a single sector or industry. That rather pessimistic view of the lack of the overall diversity of potential earnings growth has become unrealistic (there are currently about 160 companies within the S&P 500® with earnings growth of 25% or more), and that extreme view has led growth investors to generally ignore valuation.

So, a key difference between the two strategies is that value investing believes that many companies will grow, and one should look for the cheapest investment to partake in that growth, whereas growth investing believes only a small universe of companies have growth potential and one should downplay value because earnings growth is a relatively scarce commodity.

The father of growth investing, T. Rowe Price Jr., didn’t believe that growth should be bought at any price. Rather, he was a proponent of buying superior growing companies whose earnings and dividends could be bought at reasonable valuations given their superior growth.

Election

Are you not entertained? In an election cycle that was undoubtedly going to be filled with twists and turns, June and July have contained a series of historical events that will be talked about and shape history for years to come. In June, a less than stellar performance from President Biden in a debate with President Trump left much to be desired from the democratic candidate. Immediately following the debate and the weeks following, Trump’s odds of winning the presidency jumped to over 60%. Calls for President Biden to suspend his campaign intensified in the weeks following with odds of other democratic nominees rising and even surpassing Biden’s chances in early July.

Then, an assassination attempt on President Trump at his rally in Pennsylvania added more fuel to the fire of the republican base. The events led to a week of unity for the republican party as many came to show support for Trump, culminating with Trump’s acceptance of the GOP nomination at the Republican National Convention.

Ever increasing calls by high-ranking democratic officials for Biden to step aside intensified over the same week, with Biden suspending his campaign for President on July 21st. Vice President Kamala Harris is now almost certain to be the democratic nominee following these events, securing endorsements, delegates, and funding rapidly.

What do the next 3-4 months look like? It’s simply anyone’s guess. We continue to believe that politics and elections do not drive market performance. We are closely monitoring and watching the events for selective opportunities, but we do not believe material allocation changes should be based on who is president. This viewpoint is based on historical fact. Markets tend to be forward-looking and driven by economic conditions. While rhetoric can shake markets leading up to the election, we continue to focus on longer term trends and economic conditions to drive our asset allocation strategies. Ultimately, CEOs and small business owners alike want to know what rules to expect for the next 4 years, and they will be able to plan for profit accordingly.

Fed

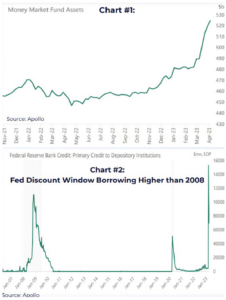

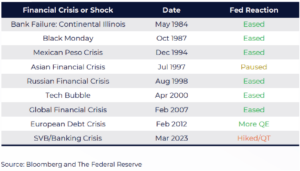

With our focus more on long-term trends and economic conditions, it is important to turn attention towards the Federal Reserve and the outlook for monetary policy.

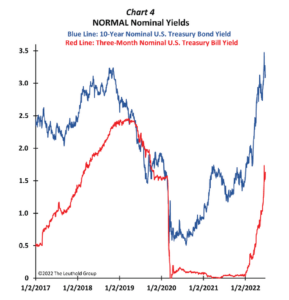

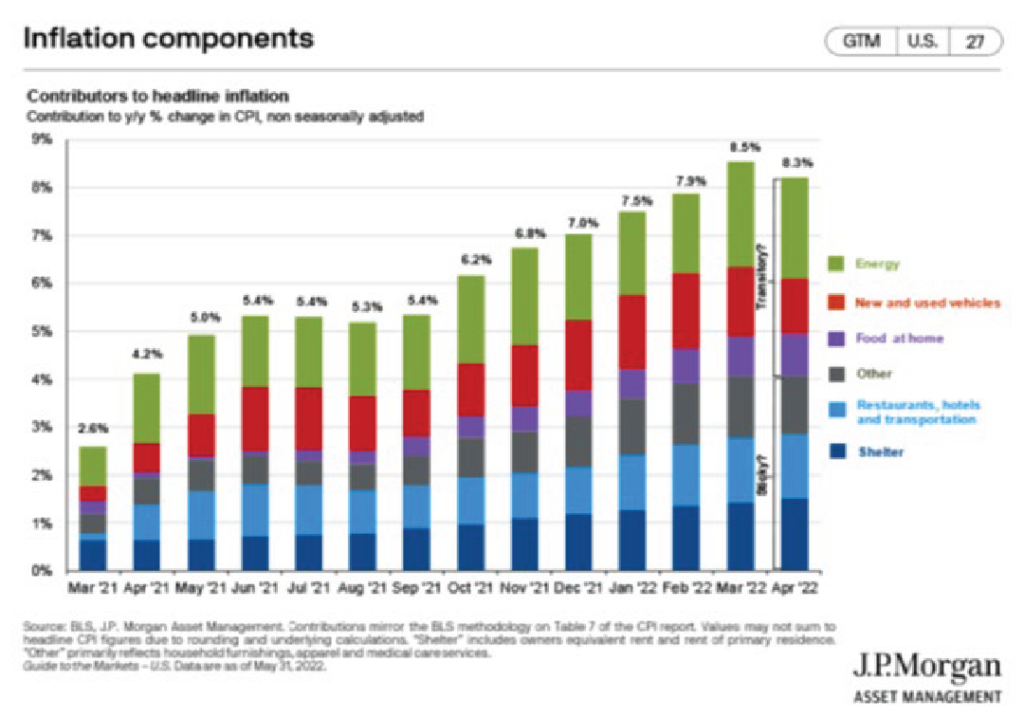

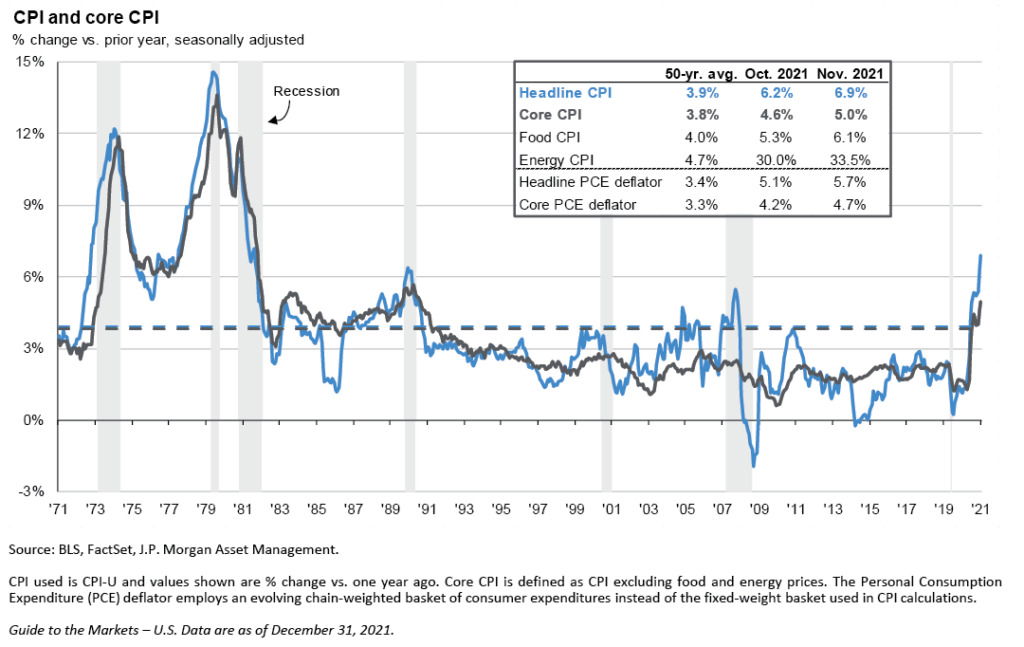

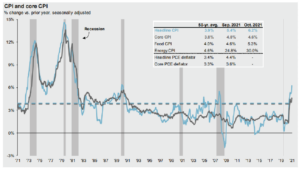

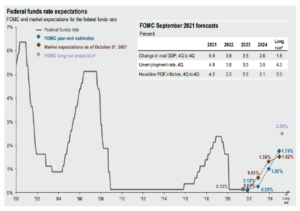

The inflation picture so far this year has been mixed but trending in the right direction. The first quarter of 2024 reported CPI numbers higher than expectations which cooled the probability of 6+ rate cuts that were expected at the start the year. Second quarter CPI has come closer to trend and fed futures markets have now priced in almost 100% probability of a rate cut in September which is parallel to fed indications.

The expectation is that inflation will continue to fall closer to the Fed target of 2-2.5% for the remainder of the year. If true, the fed will likely continue with their predetermined path to moderately reduce rates later in the year and into 2025.

Employment

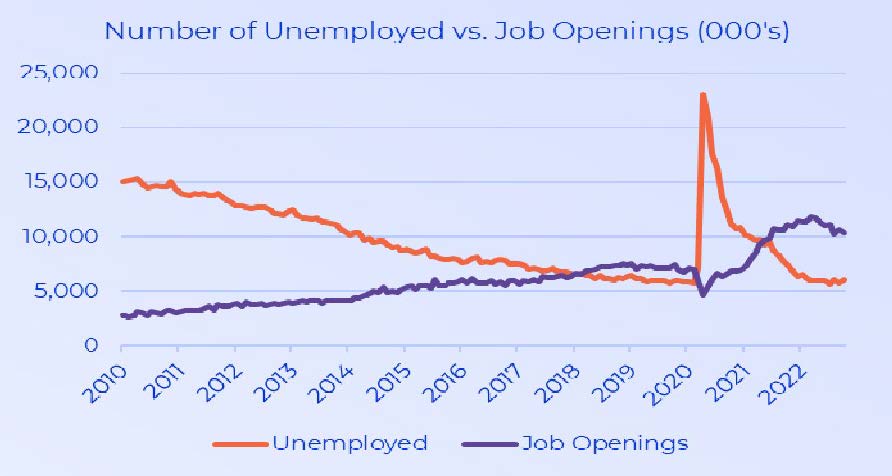

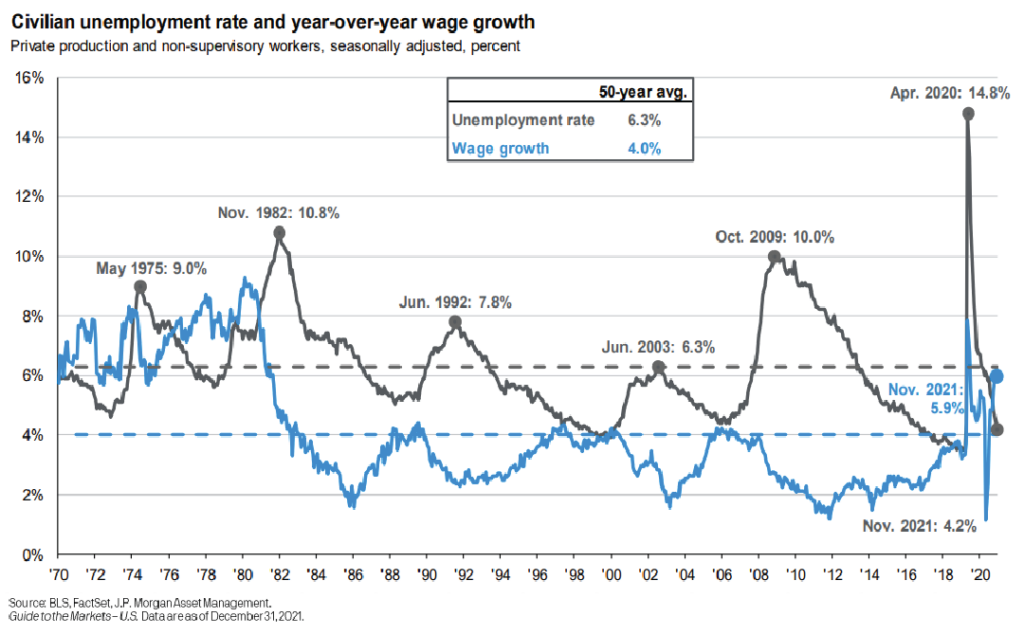

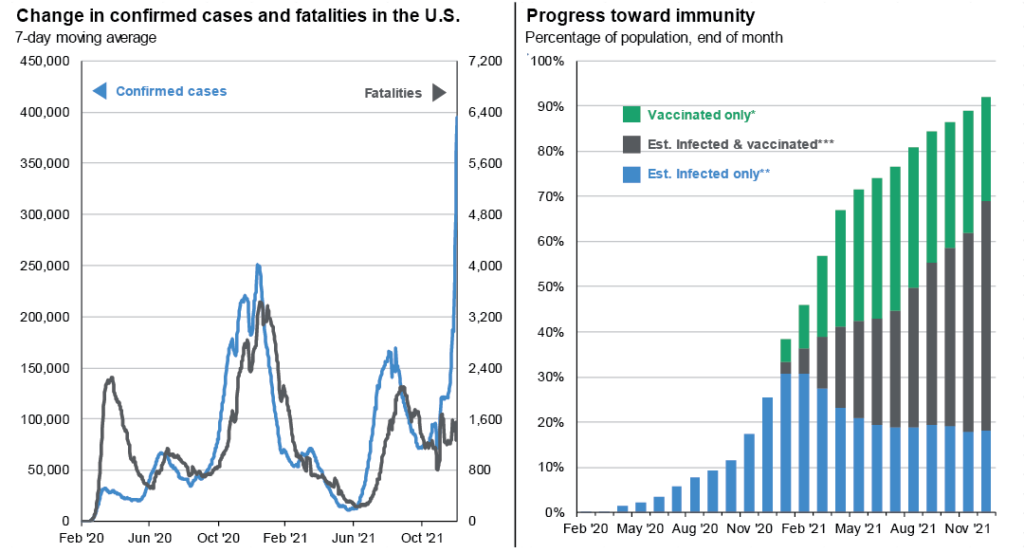

Employment continues to soften from the post pandemic hiring spree. The unemployment rate, while still very low, has come in at 4.1%, up from a low of 3.4% a year earlier. Much of this recent increase in unemployment is due to the increase in the labor participation rate from the lows of Covid, a metric that has not yet returned to pre-covid participation levels. Given that backdrop we expect the participation rate to continue to tick higher and employment figures to normalize between 4-5%.

Consumer

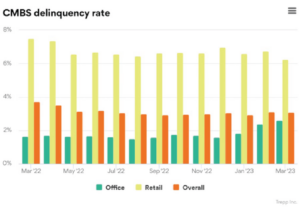

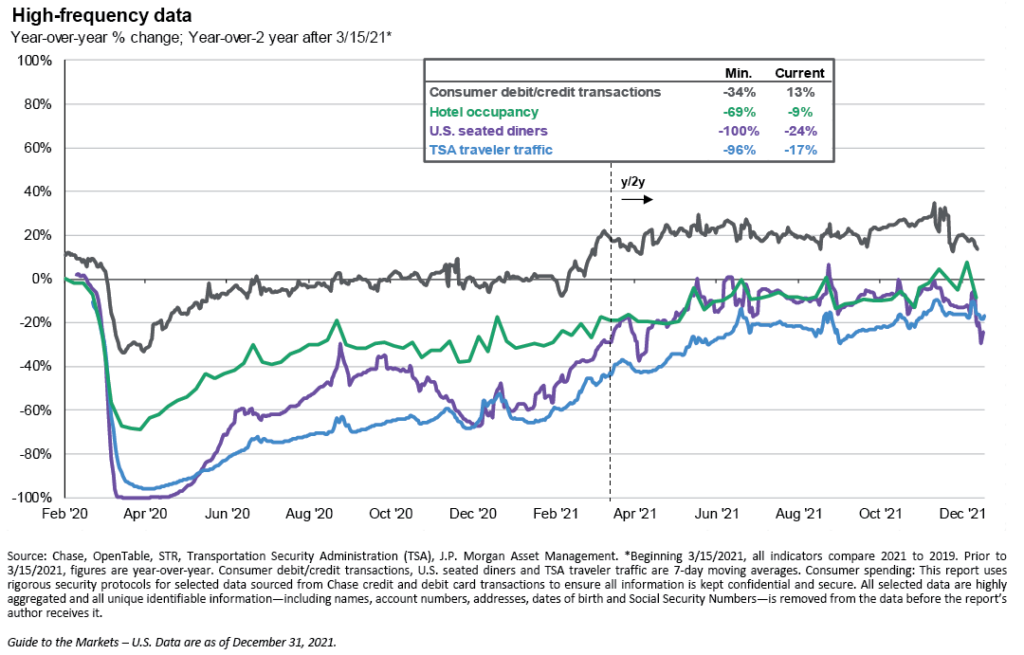

Personal consumption expenditures continue to look strong in the rear-view mirror, although we know that consumer product companies have been warning of a slowdown. Visa reported earnings with a rare top-line miss, they noted that higher borrowing costs are affecting consumer spending. Also, a few retailers have lowered their earnings guidance for this year as the consumer product industry softens.

A large part of the recent multi-year spending surge was due to the excess savings and pent-up demand created during Covid. If we look at the national savings rate, which spiked to all-time highs of 30% (of disposable income) during the pandemic, we can see that it has come down to 3.9% in the most recent reading, well below our historical average.

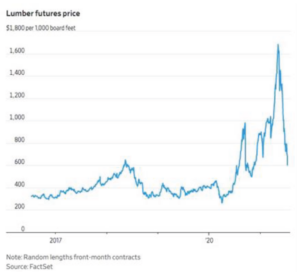

While this story rings true to many across the nation, we still see unprecedented demand for high-end retail. The luxury retailer LVMH (Louis Vuitton Moet Hennessey) reported increased sales in the US for the first half of the year. Ferrari reported double digit growth in sales in the US in 1Q24. Housing has taken a small step back as existing home sales fell 5.4% while the national average price reached a new all-time high of $426,900. The lack of inventory and expectation of lower rates in the near term continue to push prices higher in housing. It is difficult to get a clear view of how housing prices will become more affordable for the average American without a significant surge in available inventory.

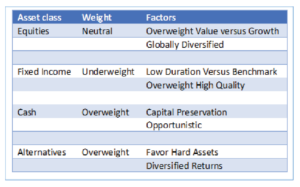

In summary, the Procyon Investment Committee has strong conviction around the broadening of market leadership outside of large growth companies because valuation matters, rate cuts coming later this year, and the lack of major market impacts related to which party wins the election. Our cumulative experience and academic study have provided our committee with the opportunity for strong debates around these key issues and we look forward to providing you updates as the second half of 2024 unfolds.

IMPORTANT DISCLAIMERS AND DISCLOSURES:

The information contained in this presentation has been gathered from sources we believe to be reliable, but we do not guarantee the accuracy or completeness of such information, and we assume no liability for damages resulting from or arising out of the use of such information. Past performance is not indicative of future results.

The views expressed in the referenced materials are subject to change based on market and other conditions. This document may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided herein does not constitute investment advice and is not a solicitation to buy or sell securities.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, investment model, or products, including the investments, investment strategies or investment themes referenced herein, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for a particular portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions.

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be direct investment, accounting, tax, or legal advice to any one investor. Consult with an accountant or attorney regarding individual accounting, tax, or legal advice. No advice may be rendered unless a client service agreement is in place.

Procyon Advisors, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). This report is provided for informational purposes only and for the intended recipient[s] only. This report is derived from numerous sources, which are believed to be reliable, but not audited by Procyon for accuracy. This report may also include opinions and forward-looking statements which may not come to pass. Information is at a point in time and subject to change.