During this Quarterly Commentary we would like to shed some light on a few topics that are top of mind this summer:

- Global vaccination rates

- Stock Markets

- Bond Markets

- Personal Finance

Where are we with vaccination rates?

The US has done a good job of delivering and administering the Covid-19 vaccines. The Biden administration and the WHO is continuing to warn against the Covid-

19 Delta variants, especially for younger people. While the major push to continue Covid-19 vaccinations in the US is pressing forward we wanted to look at the rest of the world as a proxy for how the US is coming along. These are the latest numbers on how the world is faring:

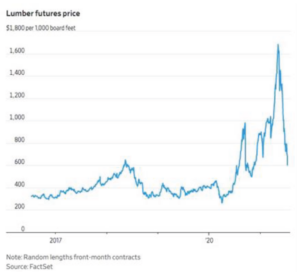

As we come through a historic cultural and societal phenomenon, we are also witnessing some economic and market effects that are unprecedented. We have seen commodity prices fluctuate wildly as evidenced by lumber prices in the enclosed chart. What seems most evident is the massive effects of printed currency, extensive fiscal borrowing, and remarkable market support by investors across many economic stakeholders. Monetary policy does not seem to be changing any time soon, although tapering discussions have already begun at the FED.

World3.51bn39.3%17.5%

| Doses administered | People aged 12+ with first dose | People aged 12+ with second dose | |

|---|---|---|---|

| Sub-Saharan Africa | 26.6m | 2.8% | 1.0% |

| South Asia | 408m | 25.7% | 6.6% |

| South America | 216m | 43.8% | 18.2% |

| Rest of Europe | 222m | 38.6% | 25.4% |

| Oceania | 11.6m | 24.4% | 9.2% |

| North America | 430m | 59.0% | 45.5% |

| MENA | 103m | 17.4% | 9.5% |

| European Union | 413m | 62.0% | 44.5% |

| East Asia | 1.61bn | 60.4% | 21.0% |

| Central Asia | 36.5m | 10.4% | 4.6% |

| Central America | 28.4m | 22.3% | 14.3 |

Market Overview:

Investors turned their focus towards inflation, interest rates, and the Federal Reserve throughout the 2nd quarter as the economic recovery continued to gain steam. Strengthening consumer confidence throughout the quarter led to increased demand for durable goods early, followed by services and travel later in the quarter as vaccination rates moved higher and re-openings swept across the country. This backdrop paved the way for strengthening economic data while the Fed continues to express patience and a willingness to remain accommodative in the face of evolving data and growing inflation.

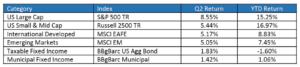

Equity markets across the globe were lifted throughout the second quarter on the back of surging demand for both durable goods and services combined with an accommodative monetary policy. US large cap equities saw the largest return out of the major equity markets during the quarter, advancing +8.55% and are now up 15.25% year to date. While US small and mid-cap stocks have outperformed their large cap counterparts year to date, they trailed in the quarter, advancing +5.44%. International markets also moved higher across the board with both international developed and emerging market equities advancing just over 5% during Q2.

Fixed Income markets were positive in the month as well as yields fell off of their recent highs, leading to price appreciation across both the taxable and municipal bond markets. The Bloomberg Barclays US Aggregate Bond index finished the quarter up +1.83% but is still down – 1.60% year to date after a challenging 1st quarter when

interest rates were on the rise. The Bloomberg Barclays Municipal Bond index was up +1.42% in the quarter and is up +1.06% year to date. High Yield fixed income continued to move higher as the risk-on market environment has prevailed throughout the first six months of the year. The BofA US High Yield Index is now up +3.70% year to date after moving +2.77% higher during the 2nd quarter.

Fixed income markets continued to defy expectations as yields across the board fell from already low levels. While pundits of all stripes vigorously debated whether nascent inflation was merely a temporary phenomenon or something more long term, bond markets ignored the noise and focused on the Fed’s confident insistence that this bout of higher prices had more to do with supply chain issues than anything else. Some feared that the Fed had overstayed its welcome by filling the ever-expanding punch bowl of monetary stimulus and that Washington ‘s spending binge would result in a suffocating level of Federal debt. But bond investors pushed back, and bonds ended up having a surprisingly strong quarter.

The June FED meeting gave important insight into what to expect going forward. In March, the survey of Fed members reflected no rate hikes until after 2023. After the June meeting, the survey reflected two hikes sometime in 2023. With a slightly less dovish stance, they also announced that a timetable for tapering bond purchases is now being discussed as the economy has a more optimistic outlook.

Lower bond yields inherently set the stage for higher bond price volatility. Year to date the bond market has experienced its ups and downs, being punished by volatility in Q1 and rewarded in Q2. The Fed has stated that long-term it wants 2% inflation and will tolerate higher inflation if it reduces unemployment. It should be noted that the yield on the benchmark index currently sits below the 2% inflation target, meaning that without price appreciation bonds will not keep up with inflation. As the economic recovery takes hold, bond investors might think about buckling their seat belts.

Earnings

As we move into the 2Q21 earning season, we anticipate mixed earnings results given the year-over- year comparisons from 2020. 2020 was a record year for many firms that benefited from the “stay-at-home” orders issued for most of the world. Our committee spends a lot of time understanding how demand from the future was pulled forward by the global pandemic for certain goods and services; we have referenced this phenomenon in previous Quarterly Commentaries as well as our Investment Committee webinars over the last year.

What we expect to see during earnings reporting is a mixed bag for the next 2-3 quarters, that will consist of earnings comparisons from companies who were completely shut down last year versus those that saw unprecedented spikes in demand for their products. Many “re-opening” companies such as travel and entertainment may have positive comparisons whereas cloud storage and video software are making comparisons to their best quarters from 2020. There is no line in the sand as to who may be able to keep up their growth figures and who may not, however the coming quarters will allow us to see if some of the new demand is permanent or transient within some of these services.

Personal Finance – Change of Pace!

We ask that you take a break from the headlines and markets from time to time to focus on you and your personal finances. A mid-year review of your personal finances is always a great idea to make sure you are on track to meet your goals and objectives. Before you go enjoy the sun and take that much needed family vacation, run through a quick checklist to make sure you are not playing catch-up in December. Here are some ideas to get you started, off the back of conversations we are having with clients right now:

1. How are your cash flows?

- Is your spending starting to change as the economy continues to re-open?

- Are you finding yourself increasingly responsible for the finances for loved ones?

2. Are you taking full advantage of retirement savings opportunities?

- It is a good time to review your budget and potentially increase your savings rate in your retirement plan. Helpful tip: if you are in the 28% tax bracket, you save roughly $280 dollars in taxes for every $1,000 you contribute pre-tax.

- 2021 Contribution Limits are as follows

- 401(k) plans, 403(b) plans, 457 and SARSEPs: $19,500 with an additional $6,000 if you are over age 50. Other plans like

- Traditional or ROTH IRA $6,000 with an additional $1,000 if you are over age 50.

- SIMPLE IRA $13,500 with an additional $3000 if you are over age 50

- SEP IRA $58,000

- Individual or Solo 401(k) is $58,000 with an additional $6,500 if you are over age 50

- Defined benefit plans are $230,000 depending on a few factors

3. Are you being as tax efficient as you can be in your financial decisions?

- There is a potential for some tax law changes to impact your portfolio. Capital gains taxes for high income earners are proposed to increase to 39%. While this aggressive plan is unlikely, it is very possible for some incremental increases from the current

- It is a good time to review your realized and unrealized gains or losses to see if there are any opportunities for tax loss harvesting. Many investment firms only do this at the end of the We advise reviewing this at least twice per year. This can help offset future capital gains later in the year in your taxable accounts. Remember, it’s not only about what you earn, but what you keep from an after-tax return standpoint.

- Now might also be a good time to revisit your plans to contribute to charitable organizations and take advantage of tax-efficient ways to donate, including through Donor Advised Funds, Qualified Charitable Distributions from your IRA, or via highly appreciated stock

- Are you taking advantage of the annual gift tax exclusion?

- If you have loved ones with 529 plans, are you contributing to them?

4. Are you looking at the debt side of your finances?

- We often focus on the above-mentioned items but with attractive interest rates many households might want to consider if refinancing or taking out a home equity line of credit makes sense while interest rates are still

- It is important to have the conversation because many of the factors that play into these decisions can impact your overall financial

5. Life Insurance, Long Term Care & Estate Planning

- COVID-19 has prompted many to question whether they have appropriate life insurance coverage, if long term care insurance should be considered or if changes need to be made to their estate plan or wills

- We understand that these are broad topics and there are a lot of details that need to be discussed but it is essential to start the conversation so you can make informed financial

As always, we hope you have found our quarterly commentary informative. The Procyon Investment Committee, as well as the entire Procyon family, wishes you and your families an enjoyable summer. We look forward to seeing you soon!

Download PDF BACK